A Beginner’s Guide to Solar Incentives

Feb 09, 2023|

by EverBright

by EverBright

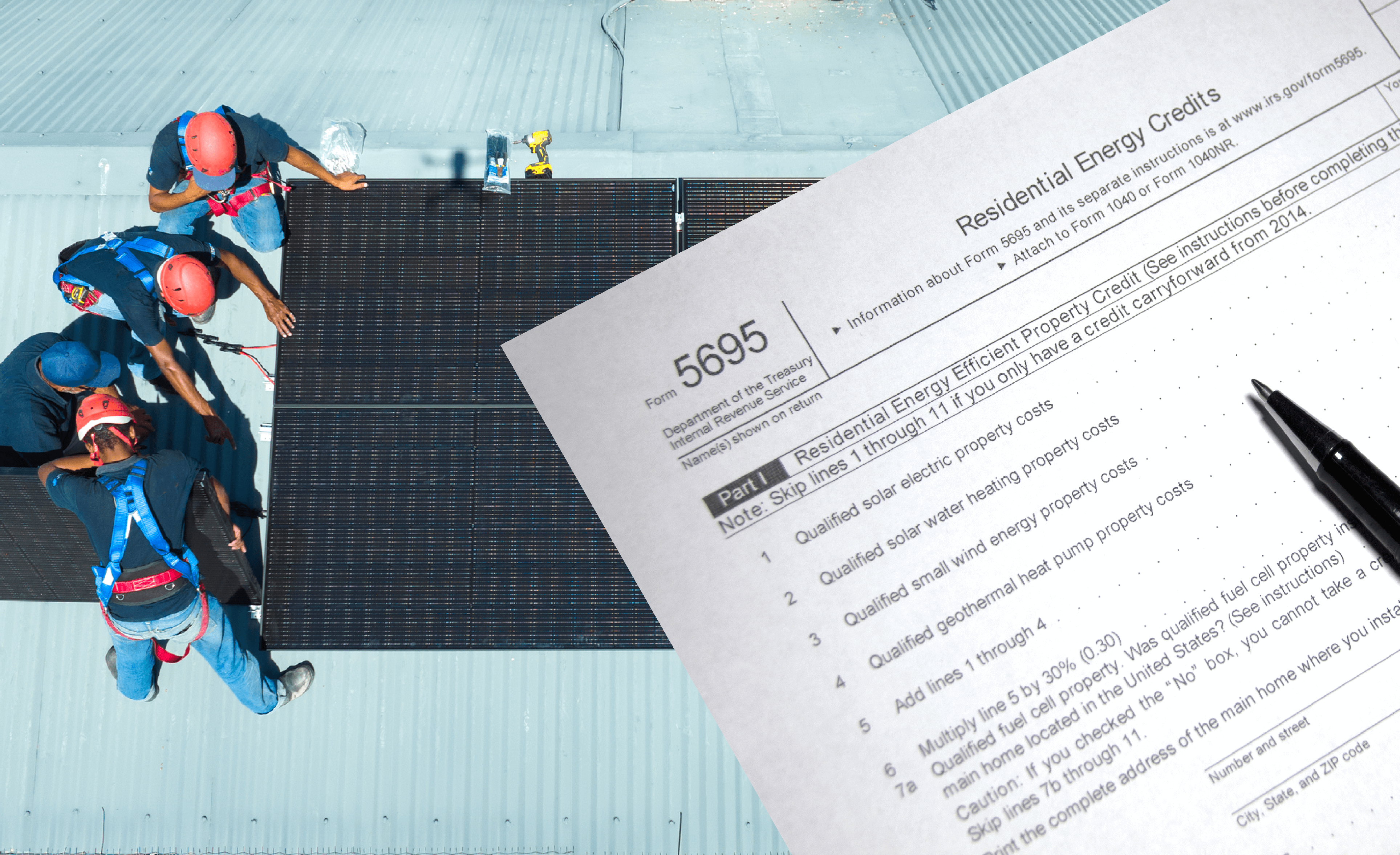

Are you thinking about going solar? Did you know a federal solar tax credit can reduce the cost of a home solar-energy system by 30%?

Aside from the obvious benefits of installing a home solar system, like cost savings and an increase in your property value, another major perk that helps seal the deal for most homeowners looking to go solar is all the available tax rebates.

What are federal tax credits and incentives for solar and battery storage?

The federal solar incentive comes in the form of an investment tax credit (ITC), which is a credit you claim on your federal income taxes the same year you install your solar panels. The Federal Solar Investment Tax Credit has offered solar-energy system homeowners a rather generous one-time 30% deduction on their federal return. That credit can significantly reduce the cost of a rooftop solar energy system.

In 2006, Congress introduced and continually renewed the Energy Policy Act under the Bush administration. In 2022, the Biden administration launched the Inflation Reduction Act (IRA), which included direct measures to make solar energy more affordable and accessible to homeowners nationwide.

The IRA comes with a $370 billion dollar budget, a large portion of which goes towards tax credits and incentives for clean energy improvements, like solar panels and battery storage.

Thanks to the new IRA nationwide incentive, you can claim 30% of the total installation cost of your solar home project on your federal income taxes.

STATE-WIDE SOLAR ENERGY TAX INCENTIVES

36/50 States incentivize homeowners to go solar.

On top of federal tax incentives for homeowners going solar, additional state and local tax incentives could save you even more money.

You already know that you're able to claim 30% of the total installation cost of your solar home project on your federal income taxes. But did you know on top of that, 36 states have property-tax exemptions for solar energy?

Also, in many states, solar equipment is exempt from sales tax. If you live in one of these states, your real estate taxes won't go up if you add a solar energy system, but your property value will.

For example:

The New York Solar Energy System Equipment Credit equals 25% of your qualified solar energy system equipment expenditures, which would put $5,000 back in your pocket.

According to Ecowatch, these are the top nine states ranked for their solar power tax incentives:

New York

Massachusetts

Maryland

Oregon

Illinois

New Hampshire

California

Washington

South Carolina

ADDITIONAL TAX REBATES

Wait, that's not all--there are even more incentives available!

Now that you know more about federal tax credits and state-wide tax exemptions, you'll also be pleased to know that, thanks to the Department of Energy's Office of Energy Efficiency and Renewable Energy, you’re also able to claim:

Labor costs for assembly and installation, including permit and inspection fees, and sales tax on certain expenses.

You can claim energy storage devices charged exclusively by the associated solar photovoltaic panels.

All the equipment used in the solar system includes wiring, batteries, safety equipment, and mounting equipment.

After all these incentives, installing a home solar system looks like a bright investment today, next year, and in the long term. So, if you're considering clean energy upgrades for your home, get an EverBright proposal to see the impact of tax incentives and other available perks before making your decision.

Recommended Posts

HOMEOWNERS

A beginner’s guide to solar incentives

Feb 6, 2023

From local and state-specific to federal and beyond: this is your guide to all solar incentives, tax exemptions, and rebates.

HOMEOWNERS

How much can solar panels increase my home value?

Feb 5, 2023

Solar energy is a wise investment for your home, from monthly energy cost savings to potentially increasing your home’s resale value by 4.1%.

HOMEOWNERS

Want to finance your home solar system?

Feb 2, 2023

Going solar is still new for most of us and can be a bit intimidating. In this article, we want to help you get familiar with some solar financing options available.